Investment clients

an overview of our investment business

SAANEN BANK - A SUCCESS STORY

Saanenland, where banking matters – a successful approach since 1874. With our balance of tradition and modernity, we are celebrating 150 years as an expert and flexible banking partner in the region.

STRONG AND DIVERSE - LIKE THE REGION

With branches in Gstaad, Gsteig, Lauenen and Schönried and the Head Office in Saanen, we are close to our clients and to the region. All decisions are made onsite. The prestige and international fame of the touristic region of Gstaad testify about the economical potential of the Saanenland.

GSTAAD'S PRIVATE BANK - OUR STRENGTHS

INDEPENDENT

In the investment business, independence is an important prerequisite for objective client advice. We act independently and make decisions in such a way that the optimal product mix is selected from the entire product range without conflicts of interest.

TRANSPARENT

We offer investment proposals tailored to your requirements with transparent investments. Instead of complex investment products, we prefer direct investments and diversify portfolios efficiently with index tools, gold and real estate investments.

RELIABLE

Trust is created through proximity, continuity and the certainty that promises will be kept.

ASSET MANAGEMENT

DelegATE

Our asset management focuses on the long-term preservation of the value of your assets. We invest the assets entrusted to us according to simple and clear principles, strategically position our client portfolios and practice active portfolio management. Our focus is on direct investments and inexpensive index tools. Illiquid asset classes such as hedge funds are excluded from our investment universe.

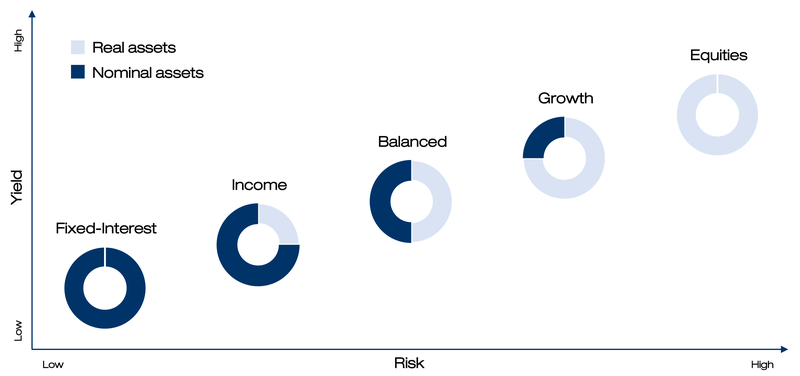

Your individual goals are at the core of every mandate. Through a personal conversation, we will determine your investment profile together – based on your risk tolerance (financial framework), your risk appetite and the opportunities that result from this. This individually developed investment strategy is based on the five classic profiles:

SUSTAINABILITY

The Bank takes ESG aspects pertaining to the environment (e.g. energy and water consumption), society (e.g. employer attractiveness and supply chain management) and governance (e.g. compensation policy and company management) into account in the investment process. We strive for the best-in-class approach. We obtain our ESG data (ratings) from MSCI. The portfolio averages of our asset management mandates are not permitted to fall below a “BBB rating”.

CLASSIC ASSET MANAGEMENT

From assets worth over CHF 100,000, we offer you our classic asset management. In addition to the investment strategies mentioned above, which we implement with our rule-based model (among other things), we offer additional strategies with a focus on the Swiss home market.

INDEXED ASSET MANAGEMENT

With indexed asset management, we have created a simple asset management concept that enables investments from as little as CHF 10,000. Transparent index tools are thereby efficiently combined.

STRATEGIC ASSET ALLOCATION

Based on your investment profile, our investment commission determines the strategy for each individual asset class. The strategic asset allocation (SAA) is regularly reviewed and adjusted to the global economic situation.

TACTICAL ASSET ALLOCATION

Based on the current market situation, the investment commission decides on tactical overweighting or underweighting of the asset classes. Our investment experts rely on the cooperation with our long-standing partner Rahn+Bodmer Banquiers as well as the internal analysis of market data. The securities are selected on the basis of fundamental and technical analyses. .

CONTROLLING

Risk management is an integral part of the entire investment process. We pay attention to optimum portfolio diversification. In our risk management, we implement the client’s specifications and strictly adhere to the internal provisions and the guidelines of the Swiss Bankers Association.

IMPLEMENTATION USING CORE SATELLITE APPROACH ....

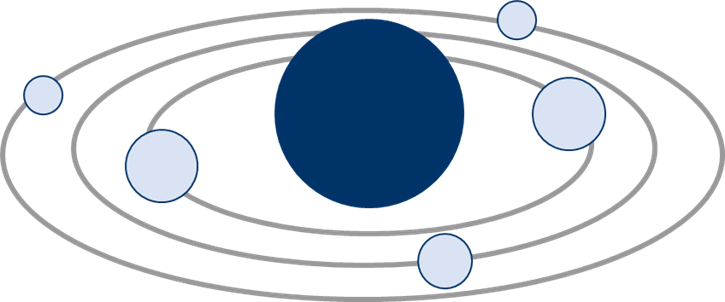

We implement your specifications in your securities portfolio using what is known as the satellite approach. This process is based on the division of your capital into core investments and supplementary securities (satellites). The foundation of a robust portfolio is formed by the core investments, which ensure that the portfolio is aligned with the market. These investments are carefully supplemented by satellites that we actively manage, which are used specifically to take advantage of short-term tactical opportunities..

... AND USING A RULE-BASED MODEL

Many investors let their emotions guide their investment decisions. However, by following fixed rules instead, you can protect yourself from poor decisions. Our approach is based on simple, predefined rules that are implemented in a disciplined manner. We thereby limit losses in turbulent market phases and ensure timely realisation of profits in an upward trend by successively adjusting the limits.

OTHER FORMS OF COLLABORATION

DECIDE YOURSELF

With the commencement of the Swiss Financial Services Act (FinSA), investor protection was significantly strengthened and the possible forms of cooperation in the investment business were standardised. All investment clients are classified by us as “private clients” and thus receive the highest level of protection in accordance with FinSA. You can find more information on this in the enclosed brochure “Information about the investment business of SB Saanen Bank Ltd.”.

In addition to asset management, we offer you the following two forms of cooperation:

TRANSACTIONAL INVESTMENT ADVICE

Do you prefer to implement your investment strategy yourself, but would like expert advice and support with regard to individual transactions? Our investment experts are available to you as sparring partners when required, and support you with their knowledge and experience. However, you retain full flexibility by making all investment decisions yourself.

EXECUTION ONLY

Best execution – not only with the broker, also with us. Do you prefer to make your investment decisions independently? And are you looking for an appropriate platform to implement your investment ideas? Our user-friendly online services give you a detailed overview of the development of your portfolio at all times. You can place stock market orders at any time in e-banking and during business hours via our securities trading

TAKE ADVANTAGE OF OUR MANY YEARS OF EXPERIENCE

tRY US

Your goals are our goals – we are only satisfied when you are. For our team, personal contact and trusting cooperation are the most important basis for long-term, successful cooperation.

Current interest rates as of

1st april 2025

| Youth account Free 25 | 1.00% * 0.00% ** |

| Private account | 0.10% * 0.00% ** |

| Business account | 0.05% *** 0.00% **** |

| Savings account flex | 0.45% |

| Money market account ***** | 0.55% |

| Active savings account****** | 0.75% |

| * ≤ 50'000 ** > 50'000 *** ≤ 100'000 **** > 100'000 ***** Minimum deposit ****** Minimum deposit | 100,000.-- 5,000.-- |

Pay-in slip number: 01-613-6

Postal account number: 30-38105-1

BIC/SWIFT: RBABCH22342